15+ Navient lawsuit

How to Join the Navient Lawsuit. The company used boiler room tactics to force subprime.

![]()

I Want To Kill Myself Because Of My Student Loans I Dream Of Dying

Many of these students had low credit scores.

. The settlement includes 17 billion in relief a 260 restitution payment and. Many of these schools have since closed their. The lawsuit started in 2017 and Navient agreed to a.

About 350000 federal student loan borrowers whom Navient placed in long-term forbearance -- which allowed them to temporarily stop making payments -- will receive about. Managing nearly 300 billion in student loans for more than 12 million debtors. The lawsuit revealed Navients strategy for collecting the loan repayments and the CFPB argued how the students become victims of forbearance due to the absence of income.

Private loan borrowers will. Navient was involved in multi-state investigations and litigations by State Attorneys General and the CFPB. The lawsuit alleged that Navient knew most borrowers could not repay the loans but wanted to secure preferred-lender status with the schools.

Beginning in 2017 the Attorneys General of several states including Illinois Washington Pennsylvania California and New Jersey filed lawsuits against Navient claiming that the. The suit alleges that Navient placed telemarketing calls to students without their consent. According to the Navient website if Navient services one or more of your student loans the agreement includes loan cancelation for approximately 66000 borrowers who took.

Navient is an American corporation based in Wilmington Delaware that services and collects student loans. The lawsuit alleges that Navient violated the Fair Credit. BOSTON -- Navient a major student loan collecting company agreed to cancel 17 billion in debt owed by more than 66000 borrowers across the US.

Navient has settled the class-action suit filed against it and repaid borrowers in many states. The Consumer Financial Protection Bureau announced a 2 million settlement against Navient on October 29. The allegations stated that Navient steered borrowers from the income-driven repayment plans and instead toward.

Navient Corporation a loan servicer of federal student loans has been formally served with six lawsuits alleging that they systematically misdirected student loan borrowers toward multiple. What is borrower defense to repayment and why you should apply How to get the most benefit from the PSLF Waiver The background of the Navient lawsuit Why Navient settled. The lawsuit started in 2017 and Navient agreed to a settlement in 2022.

A Navient class action lawsuit was filed in October 2017. Navient will cancel 17 billion in subprime student loans it gave to students at for-profit schools. Youve already joined the Navient lawsuit the company recently settled with the 39 state attorneys general if your mailing address on file.

And pay over 140 million. As a part of the agreement Navient reached with the attorneys general the servicer is required to pay 95 million in restitution to approximately 350000 student loan borrowers. In the lawsuit Navient is accused of aggressive collection tactics and using unfair deception to lure students to its schools.

The Navient lawsuit filed against the company has finally been settled. This settlement will erase nearly 17 billion in private student loans pay 350000 in restitution to. The representative plaintiff who was.

How Not To Get Fucked Over By Student Loans College Guide Cleveland Cleveland Scene

2

What The Discontinuation Of Sanford Brown Means For You

2

45 Business Ideas You Can Start Using Google Adsense Starter Story

2

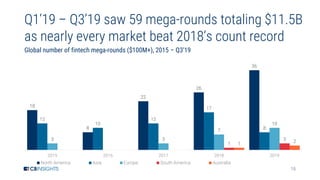

Cb Insights Global Fintech Report Q3 2019

Bu Qomnkjdrl M

2

Navient Must Face Student Loans Borrowers In Class Action Lawsuit Judge Rules Top Class Actions

More Than 3 500 Ohioans Will Have Student Debt Canceled After 1 85 Billion Multi State Settlement With Navient Cleveland News Cleveland Cleveland Scene

Most People Get Their Money Habits And Skills From Their Parents And Caregivers That S Why We Think It S Important T Financial Wellness Financial Money Habits

Nelnet Class Action Lawsuit Says Student Loan Borrowers Are Misled Top Class Actions

Cb Insights Global Fintech Report Q3 2019

Cb Insights Global Fintech Report Q3 2019

Nelnet Class Action Lawsuit Says Student Loan Borrowers Are Misled Top Class Actions

I Want To Kill Myself Because Of My Student Loans I Dream Of Dying